Shale sweepstakes

From Wikimarcellus

| Revision as of 00:30, 29 September 2008 Tcopley (Talk | contribs) ← Previous diff |

Current revision Tcopley (Talk | contribs) |

||

| Line 1: | Line 1: | ||

| - | The '''shale sweepstakes''' is a frenzied push to acquire rights to drill for natural gas found in deep shale formations throughout North America. Output from these fields is cited as one of the main reasons explaining why overall U.S. natural gas has been on the upswing, jumping 9% in 2008, after languishing for nearly a decade. The granddaddy of shale oil plays is the huge [[Barnett Shale]] field located in the vicinity of Fort Worth, Texas. | + | The '''shale sweepstakes''' represented a frenzied push to acquire drilling rights for natural gas found in deep shale formations throughout North America that occurred in the first half of 2008. Output from these fields is cited as one of the main reasons for the upswing in U.S. natural gas production. It jumped 9% in 2008, after languishing for nearly a decade. The granddaddy of shale gas plays is the huge [[Barnett shale]] field located in the vicinity of Fort Worth, Texas. |

| - | <center>http://www.sonic.net/~tcopley/img/shale.jpg<br>Source: [http://www.thenational.ae/|The National]</center> | + | <center>http://www.sonic.net/~tcopley/img/shale.jpg<br>Source: [http://www.thenational.ae/ The National]</center> |

| + | |||

| + | Two dozen shale beds in North America may have substantial quantities of natural gas. | ||

| + | |||

| + | With the collapse of natural gas prices that occurred in the second half of 2008 and early 2009, as well as the parallel credit crunch, much of the leasing activity in shale gas formations has come to a screeching halt, but considerable development and exploration continues. Many of the more established gas exploration companies had their production thoroughly hedged up through 2010 and 2011 from the high prices of the first half of 2008, and have been more or less unaffected by the collapse. | ||

| + | |||

| + | Leasing began to revive in the [[Marcellus shale]] and other [[play|plays]] during the second half of 2009. Several large Marcellus lease deals were negotiated in northeastern [[Pennsylvania]]. The activity continued into 2010 as a few substantial joint ventures brought new capital into the shale plays and lending conditions generally eased. | ||

| + | |||

| + | Costs for shale gas production are thought to be less than $2 per MCF. | ||

Current revision

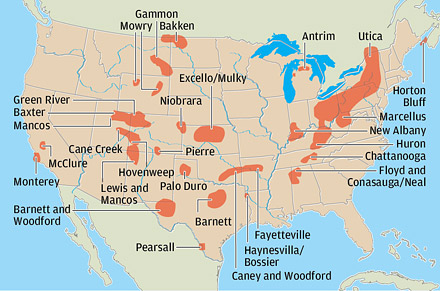

The shale sweepstakes represented a frenzied push to acquire drilling rights for natural gas found in deep shale formations throughout North America that occurred in the first half of 2008. Output from these fields is cited as one of the main reasons for the upswing in U.S. natural gas production. It jumped 9% in 2008, after languishing for nearly a decade. The granddaddy of shale gas plays is the huge Barnett shale field located in the vicinity of Fort Worth, Texas.

Two dozen shale beds in North America may have substantial quantities of natural gas.

With the collapse of natural gas prices that occurred in the second half of 2008 and early 2009, as well as the parallel credit crunch, much of the leasing activity in shale gas formations has come to a screeching halt, but considerable development and exploration continues. Many of the more established gas exploration companies had their production thoroughly hedged up through 2010 and 2011 from the high prices of the first half of 2008, and have been more or less unaffected by the collapse.

Leasing began to revive in the Marcellus shale and other plays during the second half of 2009. Several large Marcellus lease deals were negotiated in northeastern Pennsylvania. The activity continued into 2010 as a few substantial joint ventures brought new capital into the shale plays and lending conditions generally eased.

Costs for shale gas production are thought to be less than $2 per MCF.